Volkswagen Group deliveries

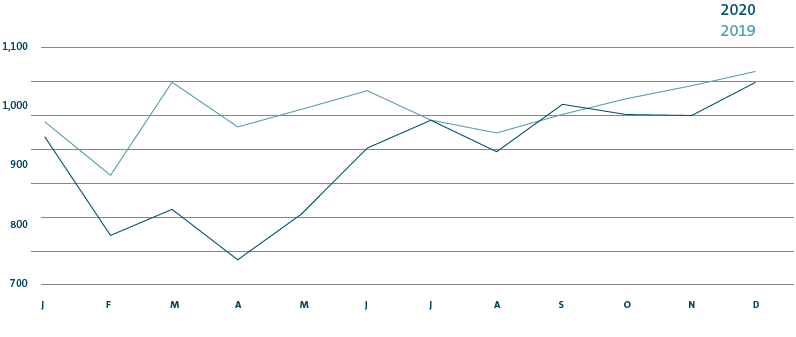

The Volkswagen Group delivered 9,305,372 vehicles to customers worldwide in fiscal year 2020. The decrease of 15.2% or 1,669,925 units year-on-year was due almost exclusively to the Covid-19 pandemic and the measures taken worldwide to contain its spread. Sales figures for both the Passenger Cars Business Area and the Commercial Vehicles Business Area declined as a result of the fall in demand. The chart below illustrates the trend in deliveries from month to month, comparing each monthly figure to the same month of the previous year. Deliveries of passenger cars and commercial vehicles are reported separately in the following.

VOLKSWAGEN GROUP DELIVERIES1 |

||||||||

|---|---|---|---|---|---|---|---|---|

|

2020 |

2019 |

% |

|||||

|

||||||||

|

|

|

|

|||||

Passenger Cars |

9,115,185 |

10,733,077 |

−15.1 |

|||||

Commercial Vehicles |

190,187 |

242,220 |

−21.5 |

|||||

Total |

9,305,372 |

10,975,297 |

−15.2 |

|||||

VOLKSWAGEN GROUP DELIVERIES BY MONTH

Vehicles in thousands

GLOBAL DELIVERIES BY THE PASSENGER CARS BUSINESS AREA

With its passenger car brands, the Volkswagen Group is present in all relevant automotive markets around the world. The key sales markets currently include Western Europe, China, the USA, Brazil, Russia, Poland, Turkey and Mexico.

Global demand for Volkswagen Group passenger cars and light commercial vehicles fell in the reporting year by 15.1% year-on-year to 9,115,185 units as a consequence of the debilitating market conditions arising from the uncertainty and the measures taken worldwide to tackle the Covid-19 pandemic. In connection with the pandemic, our deliveries to customers were affected by differing temporal and geographical effects. Following in some cases drastic losses at the end of the first quarter and the start of the second quarter, demand for Group models recovered as the reporting year went on, with declines becoming weaker. We registered declining demand year-on-year in nearly all regions. The sole exception was the Middle East region, largely driven by the positive trend in sales figures in Turkey. Bentley was the only Volkswagen Group brand that did not fall short of its prior-year figures.

Our e-mobility offensive had a positive impact on Group sales: we delivered 231,624 fully electric vehicles to customers globally – more than three times as many as in 2019. Our plug-in hybrid models were also very popular with customers; sales amounted to 190,644 vehicles. The Group’s most successful all-electric vehicles included the ID.3, the e-Golf and the e-up! from Volkswagen Passenger Cars as well as the Audi e-tron and Porsche Taycan. The Passat and the Golf from Volkswagen Passenger Cars, the Audi Q5, the ŠKODA Superb and the Porsche Cayenne were among the most popular plug-in hybrid models.

In a significantly declining overall global market, our passenger car market share increased slightly to 13.0 (12.9)%.

The table at the end of this section gives an overview of passenger car deliveries to customers of the Volkswagen Group in the regions and the key individual markets. The trends in demand for Group models in these markets and regions are described in the following sections.

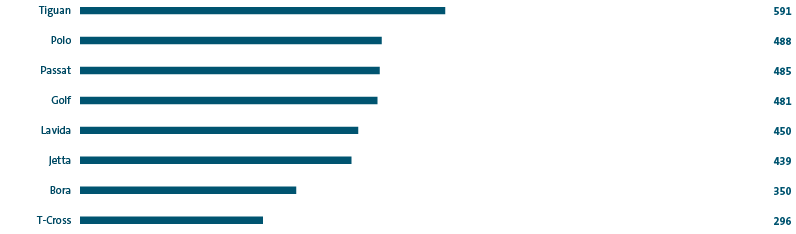

WORLDWIDE DELIVERIES OF THE MOST SUCCESSFUL GROUP MODEL RANGES IN 2020

Vehicles in thousands

Deliveries in Europe/Other Markets

In Western Europe, the Volkswagen Group delivered 2,848,861 passenger cars and light commercial vehicles to customers in fiscal year 2020 in a substantially contracting overall market. This was 21.5% fewer than in the previous year. The increasing spread of the SARS-CoV-2 virus and the measures taken to contain it sent demand for Group vehicles into a tailspin during the first quarter and at the beginning of the second quarter. All of the major individual markets demonstrated very similar declines in demand for Group vehicles. By the end of the first half of the year, the declines had tapered off. In the second half of the year, demand for Group vehicles in individual markets was once again up on a monthly basis compared with the relevant prior-year figure. The Group models with the highest volume of demand were the Golf, Polo, T-Roc and Tiguan from the Volkswagen Passenger Cars brand. In addition, the T-Cross from Volkswagen Passenger Cars, the Q3 Sportback, Q7 and e-tron from Audi, the Scala and Kamiq from ŠKODA, the Mii electric from SEAT, and the Porsche Cayenne Coupé and Porsche Taycan, all of which had been introduced as new or successor models over the course of the previous year, were very popular with customers. Some of the models successfully launched on the market during the reporting year as new or successor models were the up!, T-Roc Cabriolet, Golf, Tiguan and Arteon Shooting Brake and the first all-electric production models, the ID.3 and ID.4, from Volkswagen Passenger Cars, the A3 saloon, A3 Sportback, A5 and e-tron Sportback from Audi, the Citigoe iV, Superb iV and Octavia from ŠKODA, the Leon, Leon Sportstourer and Ateca from SEAT and the Caddy from Volkswagen Commercial Vehicles. The Volkswagen Group’s share of the passenger car market in Western Europe rose to 23.7 (22.8)%.

With a decline of 14.9%, the number of vehicles handed over to customers in the reporting year in the Central and Eastern Europe region fell less sharply than the global average. This was largely attributable to the trend in deliveries in Russia, which almost reached the prior-year level. Demand developed encouragingly for the T-Cross from Volkswagen Passenger Cars, for the Audi Q3 Sportback, for ŠKODA’s Scala, Kamiq and Karoq models and for the Porsche Cayenne Coupé. The Volkswagen Group’s share of the passenger car market in the Central and Eastern Europe region increased to 22.0 (21.5)%.

In Turkey, the Volkswagen Group continued to benefit from the catch-up effects in the overall market, raising the number of vehicles handed over to customers in 2020 by 54.8% compared with the previous year. The Passat saloon was the most sought-after Group model from the Volkswagen Passenger Cars brand. In the sharply contracting South African market, the number of Group models sold fell by 28.9%. The Polo from Volkswagen Passenger Cars continued to be the most frequently sold Group model there.

Deliveries in Germany

In Germany, demand for vehicles from the Volkswagen Group was down 19.6% year-on-year at 1,065,811 units in 2020 in an overall market that was suffering a significant decline. As with the overall market in Western Europe, the decrease was attributable to the negative impact of the spread of the SARS-CoV-2 virus. The Group models with the highest volume of demand were the Golf and Passat Estate from the Volkswagen Passenger Cars brand. Also in high demand from customers were the T-Cross from Volkswagen Passenger Cars, the Q3 Sportback, Q7 and e-tron from Audi, the Scala and Kamiq from ŠKODA, the Mii electric from SEAT, and the Porsche Cayenne Coupé and Porsche Taycan, all of which had been introduced as new or successor models over the course of the previous year. Seven Group models led the Kraftfahrt-Bundesamt (KBA – German Federal Motor Transport Authority) registration statistics in their respective segments: the Golf, T-Roc, Tiguan, Touran, Passat, Porsche 911 and Caddy. In addition, the Golf continued to top the list of the most popular passenger cars in Germany in terms of registrations.

Deliveries in North America

In North America, demand for Volkswagen Group models fell by 17.3% year-on-year to 784,299 units in the reporting year, a decrease largely mirroring the trend in the market as a whole. The impact of the Covid-19 pandemic became apparent in this region somewhat later, intensifying at the beginning of the second quarter. The month-on-month declines diminished again as the year went on. The Group’s market share was 4.6 (4.7)%. The Tiguan Allspace and Jetta from Volkswagen Passenger Cars were the most sought-after Group models in North America.

In the considerably weaker US market, the Volkswagen Group delivered 12.1% fewer vehicles to customers in fiscal year 2020 than in the prior-year period. The Group models to record the greatest increases included the Passat and Arteon from Volkswagen Passenger Cars, the Audi Q3 and e-tron, and the Porsche 911 Cabriolet. The Atlas and the Atlas Cross Sport from the Volkswagen Passenger Cars brand, Audi’s A4, A5, Q7 and e-tron Sportback models, and the Porsche Taycan and Cayenne Coupé were successfully launched on the market as new or successor models during the reporting period.

In Canada, the number of deliveries to Volkswagen Group customers fell by 25.6% year-on-year in 2020. The market as a whole experienced a lesser decline during this period. The Audi Q3 in particular recorded encouraging growth in demand.

In the Mexican market, which was diminishing sharply overall, the Volkswagen Group delivered 30.8% fewer vehicles to customers in the reporting year than in the previous year. The Group models with the highest volume of demand were the Vento and Jetta from the Volkswagen Passenger Cars brand.

Deliveries in South America

In the South American passenger car and light commercial vehicles market, which recorded a strong contraction overall, the number of Group models delivered to customers in fiscal year 2020 was down by 20.2% year-on-year to 440,326 units. The effects of the Covid-19 pandemic became apparent in this region somewhat later, intensifying at the beginning of the second quarter before weakening again on a monthly basis over the rest of the year. The new T-Cross that was launched in the previous year and the Gol from Volkswagen Passenger Cars were the Group models in highest demand. The Nivus SUV coupé was successfully launched on the market in the reporting year. The Volkswagen Group’s share of the passenger car market in South America rose to 14.1 (12.7)%.

The recovery of the Brazilian market was interrupted by the outbreak of the Covid-19 pandemic. The Volkswagen Group delivered 20.0% fewer vehicles to customers there than in the previous year. Along with the Gol and the Polo, the new T-Cross from Volkswagen Passenger Cars was in especially high demand.

In Argentina, the number of vehicles delivered to Volkswagen Group customers in 2020 was 18.4% down on the prior-year figure in a sharply declining overall market. The Gol and T-Cross from Volkswagen Passenger Cars and the Amarok from Volkswagen Commercial Vehicles saw the highest demand of all Group models.

Deliveries in the Asia-Pacific region

In fiscal year 2020, the Volkswagen Group saw demand taper off in the overall market of the Asia-Pacific region, which witnessed a noticeable decline due primarily to the Covid-19 pandemic, and handed over 4,110,782 vehicles to customers, 9.1% fewer than in the year before. The Group’s market share in the Asia-Pacific region amounted to 13.2 (13.1)%.

China, the world’s largest single market and the main growth driver of the Asia-Pacific region for many years, was distinctly weaker in the past fiscal year, mainly due to the spread of the SARS-CoV-2 virus. The Volkswagen Group delivered 9.1% fewer vehicles to customers there than in the preceding year. Following very high declines in volumes in the first quarter, we recorded a slight increase in most of the following months compared with the respective prior-year figure. The T-Cross and Teramont X from the Volkswagen Passenger Cars brand, the VA3 and VS5 from the JETTA brand, the Audi A6L and Audi Q8, the ŠKODA Kamiq GT and the Porsche Cayenne Coupé, all of which had been introduced as new or successor models over the course of the previous year, were in especially high demand. In addition, the Tayron and the Tharu from Volkswagen Passenger Cars, the Audi Q2L, Q2L e-tron and Q5, and the Porsche Panamera saloon saw encouraging growth in demand. The Tacqua, Golf, Tayron X, Tiguan X, CC, Viloran and Phideon models from Volkswagen Passenger Cars, the VS7 from the JETTA brand, the Audi Q7 and Audi e-tron and the ŠKODA Rapid were successfully launched on the market as new or successor models in the reporting year.

In the Indian passenger car market, which registered a significant decline, the Volkswagen Group saw 44.9% less demand in the reporting year than in the preceding year. The Polo from the Volkswagen Passenger Cars brand and the Rapid from ŠKODA were the most sought-after Group models there.

In a significantly weaker overall market in Japan, the number of Group models handed over to customers in fiscal year 2020 decreased by 15.6% year-on-year. The Group model to record the highest demand was the Volkswagen T-Cross.

PASSENGER CAR DELIVERIES TO CUSTOMERS BY MARKET1 |

||||||||

|---|---|---|---|---|---|---|---|---|

|

DELIVERIES (UNITS) |

CHANGE |

||||||

|

2020 |

2019 |

(%) |

|||||

|

||||||||

|

|

|

|

|||||

Europe/Other Markets |

3,779,778 |

4,712,746 |

−19.8 |

|||||

Western Europe |

2,848,861 |

3,628,314 |

−21.5 |

|||||

of which: Germany |

1,065,811 |

1,324,942 |

−19.6 |

|||||

France |

222,522 |

307,847 |

−27.7 |

|||||

United Kingdom |

409,064 |

544,117 |

−24.8 |

|||||

Italy |

239,167 |

310,944 |

−23.1 |

|||||

Spain |

213,700 |

305,494 |

−30.0 |

|||||

Central and Eastern Europe |

652,813 |

766,810 |

−14.9 |

|||||

of which: Czech Republic |

112,589 |

136,377 |

−17.4 |

|||||

Russia |

221,811 |

223,454 |

−0.7 |

|||||

Poland |

126,883 |

165,530 |

−23.3 |

|||||

Other Markets |

278,104 |

317,622 |

−12.4 |

|||||

of which: Turkey |

121,129 |

78,251 |

+54.8 |

|||||

South Africa |

64,693 |

90,968 |

−28.9 |

|||||

North America |

784,299 |

948,275 |

−17.3 |

|||||

of which: USA |

574,822 |

654,118 |

−12.1 |

|||||

Canada |

83,531 |

112,247 |

−25.6 |

|||||

Mexico |

125,946 |

181,910 |

−30.8 |

|||||

South America |

440,326 |

551,734 |

−20.2 |

|||||

of which: Brazil |

336,773 |

420,880 |

−20.0 |

|||||

Argentina |

57,555 |

70,496 |

−18.4 |

|||||

Asia-Pacific |

4,110,782 |

4,520,322 |

−9.1 |

|||||

of which: China |

3,844,679 |

4,228,841 |

−9.1 |

|||||

India |

28,423 |

51,541 |

−44.9 |

|||||

Japan |

66,935 |

79,268 |

−15.6 |

|||||

Worldwide |

9,115,185 |

10,733,077 |

−15.1 |

|||||

Volkswagen Passenger Cars |

5,328,029 |

6,279,007 |

−15.1 |

|||||

Audi |

1,692,773 |

1,845,573 |

−8.3 |

|||||

ŠKODA |

1,004,816 |

1,242,767 |

−19.1 |

|||||

SEAT |

427,035 |

574,078 |

−25.6 |

|||||

Bentley |

11,206 |

11,006 |

+1.8 |

|||||

Lamborghini |

7,430 |

8,205 |

−9.4 |

|||||

Porsche |

272,162 |

280,800 |

−3.1 |

|||||

Bugatti |

77 |

82 |

−6.1 |

|||||

Volkswagen Commercial Vehicles |

371,657 |

491,559 |

−24.4 |

|||||

COMMERCIAL VEHICLE DELIVERIES

In the period from January to December 2020, the Volkswagen Group handed over 21.5% fewer commercial vehicles to customers worldwide than in the previous year. We delivered a total of 190,187 commercial vehicles to customers. Trucks accounted for 156,378 units (−24.1%) and buses for 16,174 units (−24.8%). A total of 17,635 (14,788) vehicles from the MAN TGE van series were delivered. The decline in the truck and bus business was due to a slump in our core markets, which was exacerbated by the ongoing uncertainty generated by the Covid-19 pandemic.

In the 27 EU states excluding Malta, but plus the United Kingdom, Norway and Switzerland (EU27+3), sales were down by 26.0% on the same period of the previous year to a total of 105,131 units, of which 81,727 were trucks and 6,098 were buses. Here, the MAN brand delivered 17,306 light commercial vehicles.

In Russia, sales fell by 16.2% year-on-year to 8,486 units, comprising 8,267 trucks and 219 buses.

Deliveries in Turkey increased to 2,681 (707) vehicles in fiscal year 2020. Trucks accounted for 2,457 units and buses for 99 units, while 125 vehicles from the MAN TGE van series were sold. In South Africa, deliveries of Volkswagen Group commercial vehicles decreased by 30.2% year-on-year to a total of 3,111 units; of this figure 2,789 were trucks and 322 were buses.

Sales in North America declined in fiscal year 2020 to 1,502 vehicles (−53.3%), which were delivered almost exclusively to customers in Mexico; of this figure 1,110 units were trucks and 392 were buses.

Deliveries in South America fell to a total of 49,372 vehicles (−13.1%), of which 42,283 were trucks and 7,089 were buses. Sales in Brazil decreased by 17.5% in fiscal year 2020. Of the units delivered, 35,738 were trucks and 5,117 were buses.

In the Asia-Pacific region, the Volkswagen Group sold 11,420 vehicles to customers in the reporting period; among these, 10,331 were trucks and 1,075 were buses. Overall, this was 14.4% less than in the previous year.

COMMERCIAL VEHICLE DELIVERIES TO CUSTOMERS BY MARKET1 |

||||||||

|---|---|---|---|---|---|---|---|---|

|

DELIVERIES (UNITS) |

CHANGE |

||||||

|

2020 |

2019 |

(%) |

|||||

|

||||||||

|

|

|

|

|||||

Europe/Other Markets |

127,893 |

168,831 |

−24.2 |

|||||

of which: EU27+3 |

105,131 |

142,058 |

−26.0 |

|||||

of which: Germany |

31,859 |

39,059 |

−18.4 |

|||||

Russia |

8,486 |

10,123 |

−16.2 |

|||||

Turkey |

2,681 |

707 |

x |

|||||

South Africa |

3,111 |

4,455 |

−30.2 |

|||||

North America |

1,502 |

3,219 |

−53.3 |

|||||

of which: Mexico |

1,498 |

3,218 |

−53.4 |

|||||

South America |

49,372 |

56,826 |

−13.1 |

|||||

of which: Brazil |

40,855 |

49,551 |

−17.5 |

|||||

Asia-Pacific |

11,420 |

13,344 |

−14.4 |

|||||

Worldwide |

190,187 |

242,220 |

−21.5 |

|||||

Scania |

72,085 |

99,457 |

−27.5 |

|||||

MAN |

118,102 |

142,763 |

−17.3 |

|||||

DELIVERIES IN THE POWER ENGINEERING SEGMENT

Orders in the Power Engineering segment are usually part of major investment projects. Lead times typically range from just under one year to several years, and partial deliveries as construction progresses are common. Accordingly, there is a time lag between incoming orders and sales revenue from the new construction business.

Sales revenue in the Power Engineering segment was largely driven by Engines & Marine Systems and Turbomachinery, which together generated more than two-thirds of overall sales revenue. Until October 2020, this included the business of Renk.