Financial Position

Financial position of the Group

The Volkswagen Group’s gross cash flow decreased to €35.0 (39.9) billion in the reporting year, mainly due to the pandemic-related decline in profit. The change in working capital amounted to €−10.1 (−22.0) billion. The effects of the Covid-19 pandemic included a reduction in receivables, including in the financial services business, lower inventories because of downscaled production, a decline in other provisions and a smaller rise in liabilities. Cash outflows attributable to the diesel issue were higher than in fiscal year 2019. Cash flows from operating activities improved significantly year-on-year, to €24.9 (18.0) billion.

The Volkswagen Group’s investing activities attributable to operating activities amounted to €18.4 (20.1) billion in fiscal year 2020; this was down on the previous year, mainly due to lower capex.

Financing activities accounted for total cash inflows of €7.6 billion in the reporting year, primarily to boost gross liquidity; a cash outflow of €−0.9 billion had been recorded in the previous year. Financing activities primarily include the issuance and redemption of bonds and changes in other financial liabilities. In June 2020, hybrid notes totaling €3.0 billion were placed successfully. In September 2020, Volkswagen issued green bonds in an amount of €2.0 billion. The dividend payment to the shareholders of Volkswagen AG led to a cash outflow in October 2020 in the same amount as in the previous year. The figure for fiscal year 2019 had included the acquisition of MAN shares tendered as a result of the termination of the control and profit and loss transfer agreement, and the cash inflow resulting from the IPO of TRATON.

At the end of the reporting period, the Volkswagen Group’s cash and cash equivalents reported in the cash flow statement amounted to €33.4 (24.3) billion.

On December 31, 2020, the Volkswagen Group’s net liquidity stood at €−137.4 billion, compared with €−148.0 billion at the end of 2019.

CASH FLOW STATEMENT BY DIVISION |

||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

VOLKSWAGEN GROUP |

AUTOMOTIVE1 |

FINANCIAL SERVICES |

|||||||||||||||||||||

€ million |

2020 |

2019 |

2020 |

2019 |

2020 |

2019 |

||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||

|

||||||||||||||||||||||||

Cash and cash equivalents at beginning of period |

24,329 |

28,113 |

18,098 |

23,354 |

6,231 |

4,759 |

||||||||||||||||||

Earnings before tax |

11,667 |

18,356 |

8,891 |

15,137 |

2,776 |

3,219 |

||||||||||||||||||

Income taxes paid |

−2,646 |

−2,914 |

−2,009 |

−2,187 |

−637 |

−726 |

||||||||||||||||||

Depreciation and amortization expense2 |

27,069 |

24,439 |

17,798 |

15,958 |

9,272 |

8,480 |

||||||||||||||||||

Change in pension provisions |

806 |

342 |

767 |

320 |

39 |

23 |

||||||||||||||||||

Share of the result of equity-accounted investments |

536 |

460 |

584 |

520 |

−48 |

−59 |

||||||||||||||||||

Other noncash income/expense and reclassifications3 |

−2,461 |

−734 |

−2,388 |

−651 |

−73 |

−83 |

||||||||||||||||||

Gross cash flow |

34,971 |

39,950 |

23,642 |

29,097 |

11,329 |

10,853 |

||||||||||||||||||

Change in working capital |

−10,070 |

−21,966 |

1,079 |

1,636 |

−11,148 |

−23,603 |

||||||||||||||||||

Change in inventories |

1,334 |

−674 |

1,406 |

−345 |

−72 |

−329 |

||||||||||||||||||

Change in receivables |

712 |

−893 |

45 |

−1,176 |

668 |

283 |

||||||||||||||||||

Change in liabilities |

540 |

2,297 |

−138 |

1,564 |

678 |

733 |

||||||||||||||||||

Change in other provisions |

−2 |

1,304 |

−214 |

1,400 |

211 |

−96 |

||||||||||||||||||

Change in lease assets (excluding depreciation) |

−12,914 |

−13,204 |

52 |

−110 |

−12,966 |

−13,095 |

||||||||||||||||||

Change in financial services receivables |

260 |

−10,796 |

−72 |

303 |

332 |

−11,099 |

||||||||||||||||||

Cash flows from operating activities |

24,901 |

17,983 |

24,721 |

30,733 |

180 |

−12,750 |

||||||||||||||||||

Cash flows from investing activities attributable to operating activities |

−18,372 |

−20,076 |

−18,364 |

−19,898 |

−8 |

−178 |

||||||||||||||||||

of which: investments in property, plant and equipment, investment property and intangible assets, excluding capitalized development costs |

−11,273 |

−14,230 |

−11,065 |

−14,007 |

−208 |

−223 |

||||||||||||||||||

capitalized development costs |

−6,473 |

−5,171 |

−6,473 |

−5,171 |

– |

– |

||||||||||||||||||

acquisition and disposal of equity investments |

−1,037 |

−913 |

−1,188 |

−716 |

151 |

−196 |

||||||||||||||||||

Net cash flow4 |

6,529 |

−2,093 |

6,357 |

10,835 |

172 |

−12,928 |

||||||||||||||||||

Change in investments in securities, loans and time deposits |

−4,319 |

−1,069 |

−3,015 |

−5,018 |

−1,304 |

3,949 |

||||||||||||||||||

Cash flows from investing activities |

−22,690 |

−21,146 |

−21,379 |

−24,916 |

−1,312 |

3,771 |

||||||||||||||||||

Cash flows from financing activities |

7,637 |

−865 |

2,938 |

−11,278 |

4,699 |

10,413 |

||||||||||||||||||

of which: capital transactions with noncontrolling interests |

−238 |

1,368 |

−238 |

1,368 |

– |

– |

||||||||||||||||||

capital contributions/capital redemptions |

2,984 |

– |

2,952 |

−970 |

33 |

970 |

||||||||||||||||||

MAN noncontrolling interest shareholders: compensation payments and acquisition of shares tendered |

2 |

−1,109 |

2 |

−1,109 |

– |

– |

||||||||||||||||||

Effect of exchange rate changes on cash and cash equivalents |

−745 |

243 |

−619 |

205 |

−125 |

38 |

||||||||||||||||||

Change of loss allowance within cash & cash equivalents |

−0 |

1 |

−0 |

1 |

0 |

−0 |

||||||||||||||||||

Net change in cash and cash equivalents |

9,103 |

−3,784 |

5,660 |

−5,256 |

3,443 |

1,472 |

||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||

Cash and cash equivalents at Dec. 315 |

33,432 |

24,329 |

23,758 |

18,098 |

9,674 |

6,231 |

||||||||||||||||||

Securities, loans and time deposits |

32,645 |

29,099 |

15,868 |

13,458 |

16,777 |

15,641 |

||||||||||||||||||

Gross liquidity |

66,078 |

53,428 |

39,626 |

31,556 |

26,451 |

21,872 |

||||||||||||||||||

Total third-party borrowings |

−203,457 |

−201,468 |

−12,830 |

−10,280 |

−190,627 |

−191,189 |

||||||||||||||||||

Net liquidity6 |

−137,380 |

−148,040 |

26,796 |

21,276 |

−164,176 |

−169,316 |

||||||||||||||||||

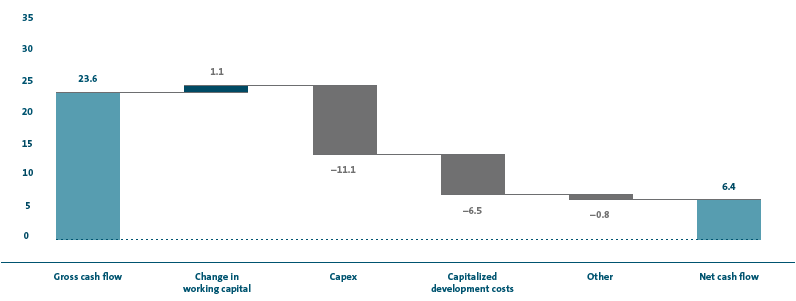

AUTOMOTIVE DIVISION NET CASH FLOW

€ billion

Financial position of the Automotive Division

In the period from January to December 2020, the Automotive Division’s gross cash flow was €23.6 billion, down €5.5 billion on the previous year due to earnings-related factors. Working capital, which underwent very different changes in the individual quarters, amounted to €1.1 (1.6) billion. The effects of the Covid-19 pandemic included lower inventories because of downscaled production, a reduction in receivables as well as lower liabilities and a decline in other provisions. Cash outflows attributable to the diesel issue were higher than a year earlier. Consequently, cash flows from operating activities were down €6.0 billion to €24.7 billion.

Investing activities attributable to operating activities decreased by €18.4 billion to €1.5 billion. Investments in property, plant and equipment, investment property and intangible assets, excluding capitalized development costs (capex) included in this figure declined by €2.9 billion to €11.1 billion. Despite a drop in sales revenue as a result of the pandemic, the ratio of capex to sales revenue was 6.1 (6.6)% down on the prior-year figure due to a significant fall in capex. Capex was primarily allocated to our production facilities and to models that we launched in 2020 or are planning to launch in 2021, or for which production is set to start. These are primarily vehicles in the ID. family and in the Golf, Audi Q4 e-tron, Audi Q6 e-tron, Audi e-tron GT, ŠKODA Enyaq model series, the new generation of the ŠKODA Fabia, the SEAT Leon family, as well as the CUPRA Formentor, the Porsche Taycan, the Porsche Macan and Bentley’s Bentayga. Other investment priorities included the ecological focus of our model range, product electrification and digitalization, and our modular toolkits. The increase in capitalized development costs to €6.5 (5.2) billion is primarily due to product impairment tests, which have had to be performed at brand level since the end of 2019. The “acquisition and disposal of equity investments” item went up by €0.5 billion to €1.2 billion as a result of strategic investments in a number of companies, in particular the Argo AI joint venture; this was offset by the cash provided by the sale of Renk.

The Automotive Division’s net cash flow fell by €4.5 billion to €6.4 billion in the reporting period.

Financing activities relate to the issuance and redemption of bonds and changes in other financial liabilities; the total cash inflow in this item was €2.9 billion in fiscal year 2020. This helped boost gross liquidity and resulted in higher liabilities to banks. The hybrid notes with a principal amount of €3.0 billion, which were successfully issued via Volkswagen International Finance N.V. in June 2020, led to cash inflows. The first one is a €1.5 billion note that has a coupon of 3.5% and can first be called after five years, and the other is a €1.5 billion note that has a coupon of 3.875% and can first be called after nine years. Both notes have perpetual maturities and increase equity, net of transaction and other costs. An amount of €3.0 billion of the hybrid notes was eligible to be classified as a capital contribution and led to a rise in net liquidity. In addition, the green bonds of €2.0 billion issued in September 2020 are included in financing activities. A dividend of €2.4 (2.4) billion was distributed to the shareholders of Volkswagen AG in October 2020. The “capital transactions with noncontrolling interests” item includes the cash outflow of €0.2 billion for the transfer of all outstanding Audi shares to Volkswagen AG. In the previous year, financing activities accounted for cash outflows of €11.3 billion. This figure also included the acquisition of MAN shares tendered as a result of the termination of the control and profit and loss transfer agreement with MAN SE, which was set against the cash inflow resulting from the IPO of TRATON.

At the end of the reporting year, the Automotive Division’s net liquidity was up €5.5 billion, at €26.8 billion. Driven by the increase in net liquidity and the decrease in sales revenue, the Automotive Division’s net liquidity accounted for 12.0 (8.4)% of consolidated sales revenue in the reporting period.

FINANCIAL POSITION IN THE PASSENGER CARS BUSINESS AREA |

||||

|---|---|---|---|---|

€ million |

2020 |

2019 |

||

|

|

|

||

Gross cash flow |

21,823 |

25,474 |

||

Change in working capital |

331 |

3,053 |

||

Cash flows from operating activities |

22,154 |

28,528 |

||

Cash flows from investing activities attributable to operating activities |

−16,762 |

−20,254 |

||

Net cash flow |

5,392 |

8,273 |

||

Due to the pandemic-related decline in profit, the gross cash flow generated by the Passenger Cars Business Area was €21.8 billion in fiscal year 2020, having experienced a decline of €3.7 billion compared with the previous year. The change in working capital amounted to €0.3 (3.1) billion. The effects of the Covid-19 pandemic included lower inventories, a reduction in receivables, lower liabilities and a decline in other provisions. The cash outflows attributable to the diesel issue were higher in the reporting period than a year earlier. Cash flows from operating activities were down by €6.4 billion to €22.2 billion. Investing activities attributable to operating activities in the Passenger Cars Business Area decreased to €16.8 (20.3) billion. Capex was lower, while capitalized development costs increased. The “acquisition and disposal of equity investments” item went up due to strategic investments in a number of companies, in particular the joint venture Argo AI. The Passenger Cars Business Area’s net cash flow declined by €2.9 billion to €5.4 billion.

FINANCIAL POSITION IN THE COMMERCIAL VEHICLES BUSINESS AREA |

||||

|---|---|---|---|---|

€ million |

2020 |

2019 |

||

|

|

|

||

Gross cash flow |

1,845 |

3,357 |

||

Change in working capital |

159 |

−1,249 |

||

Cash flows from operating activities |

2,004 |

2,108 |

||

Cash flows from investing activities attributable to operating activities |

−1,328 |

603 |

||

Net cash flow |

676 |

2,711 |

||

In the period from January to December 2020, the Commercial Vehicles Business Area’s gross cash flow went down by €1.5 billion to €1.8 billion due to earnings-related factors driven by the Covid-19 pandemic. The change in working capital amounted to €0.2 (−1.2) billion. Cash flows from operating activities declined by €0.1 billion to €2.0 billion. Investing activities attributable to operating activities were up on the previous year, in which the intragroup sale of the power engineering business had led to a cash inflow. Net cash flow dropped to €0.7 (2.7) billion.

FINANCIAL POSITION IN THE POWER ENGINEERING BUSINESS AREA |

||||

|---|---|---|---|---|

€ million |

2020 |

2019 |

||

|

|

|

||

Gross cash flow |

−25 |

265 |

||

Change in working capital |

588 |

−168 |

||

Cash flows from operating activities |

562 |

98 |

||

Cash flows from investing activities attributable to operating activities |

−274 |

−247 |

||

Net cash flow |

289 |

−150 |

||

In the reporting year, gross cash flow in the Power Engineering Business Area declined to €0.0 (0.3) billion year-on-year, primarily as a result of a deterioration in profit. Due to a reduction in receivables and restructuring expenses that have not yet led to cash outflows, the change in working capital amounted to €0.6 (−0.2) billion. Cash flows from operating activities rose by €0.5 billion year-on-year, to €0.6 billion. Investing activities attributable to operating activities increased by 10.6% to €0.3 billion. Net cash flow improved by €0.4 billion to €0.3 billion.

Financial position in the Financial Services Division

In the period from January to December 2020, the Financial Services Division generated gross cash flow of €11.3 (10.9) billion. Given a decrease in funds tied up in working capital caused by the lower business volume in response to the decline in demand following the spread of the SARS-CoV-2 virus, the change in working capital amounted to €−11.1 (−23.6) billion. Cash flows from operating activities improved by €12.9 billion to €0.2 billion.

At €0.0 (0.2) billion, investing activities attributable to operating activities were below the prior-year figure.

The Financial Services Division’s financing activities relate primarily to the issuance and redemption of bonds and other financial liabilities; there was a total cash inflow of €4.7 billion to refinance the business volume in the reporting period, compared with €10.4 billion in the previous year.

At the end of the reporting period, the Financial Services Division’s negative net liquidity, which is common in the industry, stood at €−164.2 billion, compared with €−169.3 billion on December 31, 2019.