Shares and Bonds

Following the sharp fall in share prices triggered by the Covid-19 pandemic, trading in Volkswagen AG’s ordinary and preferred shares recovered as the year went on, but fell short of the year-end 2019 figure. To refinance projects connected with e-mobility, green bonds were successfully placed on the market for the first time.

EQUITY MARKETS AND PERFORMANCE OF THE PRICE OF VOLKSWAGEN’S SHARES

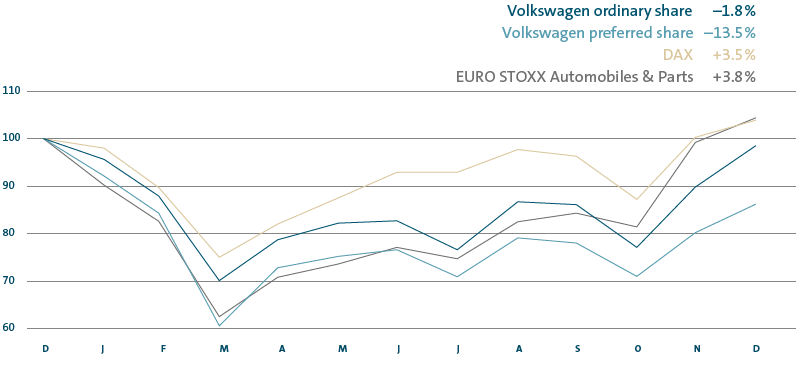

Following the sharp fall in share prices in the first quarter of 2020, which was triggered by the Covid-19 pandemic and its severe negative economic implications, international stock markets started to recover during the second quarter, with some even reporting a strong upward trend. At the end of 2020, many equity markets even recorded closing levels above the prior-year levels.

The DAX recorded an increase of 3.5% compared with the end of 2019. After an initially good start to the new financial year with a record high in February, share prices collapsed with the increasing spread of the SARS-CoV-2 virus. Starting from the low reached in March, the leading German stock index then again gained in value and recouped its losses in the fourth quarter. This development was fueled considerably by economic stimulus measures from central banks and governments throughout the world and the resulting hopes of a more rapid global economic recovery. The upward trend lost momentum in the second half of the year, with the impact of the second wave of infections weighing on share price performance, although hopes of a vaccine had a positive effect.

After the losses incurred in the first quarter of 2020, the prices of Volkswagen AG’s preferred and ordinary shares also regained ground in the months that followed, but still fell short of the year-end 2019 figures by 14% and 2% respectively. Uncertainties surrounding the development of the global demand for automobiles caused by the Covid-19 pandemic placed shares under pressure. In addition, negative effects arose from the automotive industry’s current period of transition that requires large-scale investment. Moreover, the impending US punitive tariffs on European vehicles, the uncertain outcome of the negotiations on the United Kingdom’s exit from the EU Single Market including the form the future relationship takes, and the appreciation of the euro against the US dollar since May 2020 all had a negative impact. Positive momentum came from the incipient recovery of the Chinese automotive market and investors’ hopes of improved economic activity in the wake of eased restrictions worldwide, government assistance measures, and hopes that the Covid-19 pandemic would subside.

VOLKSWAGEN SHARE KEY FIGURES AND MARKET INDICES FROM JANUARY 1 TO DECEMBER 31, 2020 |

||||||||

|---|---|---|---|---|---|---|---|---|

|

|

High |

Low |

Closing |

||||

|

|

|

|

|

||||

Ordinary share |

Price (€) |

183.10 |

101.50 |

170.10 |

||||

|

Date |

Jan. 10 |

Mar. 18 |

Dec. 30 |

||||

Preferred share |

Price (€) |

185.52 |

87.20 |

152.42 |

||||

|

Date |

Jan. 10 |

Mar. 18 |

Dec. 30 |

||||

DAX |

Price |

13,790 |

8,442 |

13,719 |

||||

|

Date |

Dec. 28 |

Mar. 18 |

Dec. 30 |

||||

ESTX Auto & Parts |

Price |

509 |

255 |

505 |

||||

|

Date |

Dec. 28 |

Mar. 18 |

Dec. 30 |

||||

PRICE DEVELOPMENT FROM DECEMBER 2019 TO DECEMBER 2020

Index based on month-end prices: December 31, 2019 = 100